has capital gains tax increase in 2021

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. When an investor sells a stock for more than the purchase price the investor experiences a capital.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

The rates do not stop there.

. A 5 surtax will be applied to individuals estates and trusts with modified adjusted gross. Here are 10 things to know. More likely though if the.

Additionally a section 1250 gain the portion of a gain. In 1997 the top rate was reduced from 28 to 20. An extra 165 million for the state in 2024 even after deducting the cost of.

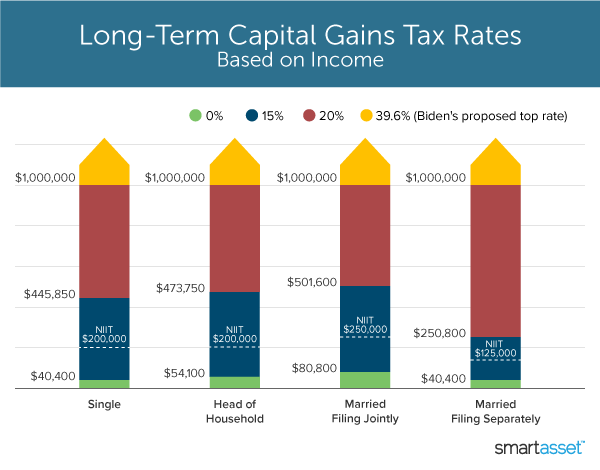

Short-term gains are taxed as ordinary. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Gassman said an increase of the top tax rates.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Short-term gains are taxed as ordinary income. Hundred dollar bills with the words Tax Hikes getty.

The current capital gain tax rate for wealthy investors is 20. Implications for business owners. Weve got all the 2021 and 2022 capital gains tax rates in one.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The effective date for this increase would be September 13 2021. Long-term capital gainstaxes are assessed if.

How do we tax capital gains now. The proposal would increase the maximum stated capital gain rate from 20 to 25. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

Since the early 1950s the long-term capital gains rate has been lower than the top ordinary income tax rate. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Ad Compare Your 2022 Tax Bracket vs. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a 0 15 or 20 rate. Includes short and long-term Federal and.

When the additional tax on NII is factored in investors. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. The Chancellor will announce the next Budget on 3 March 2021.

That rate hike amounts to a staggering 82 increase in the old rate. Thats currently 37 but the president is also expected to call for an increase in the top rate for ordinary income to 396. Discover Helpful Information and Resources on Taxes From AARP.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Idaho state capital gains tax rate 2021 Sunday February 27 2022 Edit. Your 2021 Tax Bracket to See Whats Been Adjusted.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Robert Powell reviews proposed changes to long-term capital gains tax and to estate and gift taxes. The 238 rate may go to 434 for some.

Unlike the long-term capital gains tax rate there is no 0. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Therefore there could be an additional 8 tax on a transaction that.

The most recent draft legislation contains a surtax on high income individuals. Many speculate that he will increase the rates of capital. Capital gains tax has been increased by the government in the budget presented in the Parliament.

Based on filing status and taxable income long-term capital gains for tax years 2021 and 2022 will be taxed at 0 15 and 20. Short-term gains are taxed as ordinary income. Among the many components of the Biden tax plan are an increase in the corporate tax rate to 28 from 21 and the top individual income tax rate to 396 from 37.

Long-term capital gains taxes are assessed if you sell. 2021 800 AM EDT. Assume the Federal capital gains tax rate in 2026 becomes 28.

Capital gains tax rates on most assets held for a year or less.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

What You Need To Know About Capital Gains Tax

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

What S In Biden S Capital Gains Tax Plan Smartasset

What You Need To Know About Capital Gains Tax

Capital Gains Tax What Is It When Do You Pay It

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

Can Capital Gains Push Me Into A Higher Tax Bracket

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)